2016 was an eventful year for TETRA, but how did the global market fare? IHS Markit’s Ryan Darrand and Thomas Lynch sit down with Sam Fenwick to look at the data and the trends shaping current and future demand

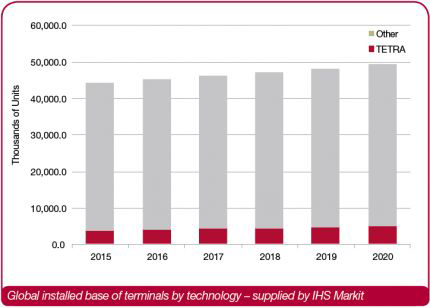

Given TETRA’s maturity as a technology, the growing focus on the use of LTE by public safety, the recent completion of both BDBOS and Nødnett, and China’s decision to use PDT for public safety, one might be forgiven for thinking that TETRA had a rough ride in 2016. However, as Ryan Darrand, senior analyst II at IHS Markit, explains, the true picture was more positive. “From a global perspective, we always anticipated terminal shipments to be subdued compared with 2015, based on the maturity of certain networks in Europe. However, 2016 was better than forecast. It was still subdued compared with 2015, but better than expected globally. We’re projecting growth over the next five years of about three per cent year-on-year globally, so the picture is still very good for TETRA.” To put this figure into context, IHS Markit expects the global LMR terminal market to grow at an average rate of four per cent year-on-year over the same period.

“I think LTE has a part to play here; people are waiting to see what will happen,” adds Thomas Lynch, director, safe cities & security, at IHS Markit. “Equally, the message we’re getting from the big nationwide networks at the moment is that they’re all pushing on with their TETRA network refreshes, so I have no doubt that the message we’ll hear at CCW is it’s business as usual and LTE is too long away, so continue to invest in TETRA.”

“I don’t expect the development of LTE to negatively impact TETRA adoption rates, and I don’t think it will replace TETRA,” says Darrand. “It may well work for data applications as a nice-to-have, but I don’t think that the users will be putting their TETRA handsets down to use LTE ones before 2021, other than the UK possibly. It hasn’t affected our projections until 2021 at all. The private networks in the Middle East – the early adopters in Qatar and the UAE – may take on some LTE early, and that may affect TETRA, but certainly not in the public safety sector, which is a good 40 per cent of the market.”

He highlights the lead-time required for the technology standardised in 3GPP Release 13 to be fully developed and deployed and the subsequent work that needs to be done with Release 14. “I don’t think anybody really expects it to work in a public safety capacity until at least 2020, and that’s being optimistic. So, we’ve seen people or organisations holding off just to see how LTE progresses.”

“It’s a mature market now,” says Lynch, “and people are just either not installing newer networks as much as they were or the replacements have slowed a little bit, either because they’re getting more efficient in using it or there has been a lot of refurbishments to TETRA devices as opposed to replacements.”

A handset’s life

Darrand adds that IHS Markit expects a TETRA unit to last an average of seven years, noting that they can last up to 10-15 years in the absence of accidental breakage. He contrasts this with LTE handsets, which have chipsets that go out of date every two to three years, requiring a similar replacement rate.

Moving on to hybrid TETRA-LTE handsets, which were debuted in 2015, Darrand says: “With each 3GPP release there is a whole process of maturity that needs to happen, from development of chipset through to device and network. This process can take on average 18 months, according to the senior R&D partners we speak with around the world. Given that public safety features are being introduced in 3GPP Releases 13, 14 and 15, it will take time for these to come to market and provide full functional TETRA/LTE capability. Because of this, there is not really a need for dual-mode devices at the moment. Speaking to the big players, they are being sold but not in any great quantity. However, given that we’re drawing nearer to the transition of the UK’s emergency services onto LTE, the projections for LTE/TETRA hybrids have gone up slightly, but it’s not until around 2019 that we start to project scalable shipments. We are projecting an average growth rate of 90 per cent year-on-year, but we’re talking very small numbers to start with.”

Darrand adds that of those public safety users who adopt LTE technology, the majority will opt for a hybrid option as the benefits of LTE to critical communications becomes clearer. However an alternate approach is being pursued by FirstNet in the US, which aspires for users to have a separate LMR handset for voice and an LTE one for data.

While we’re still on devices, LTE isn’t the only technology that competes with TETRA. What of so-callled cost-optimised technologies (DMR, dPMR, NXDN and PDT)? Darrand says that IHS Markit isn’t seeing them put any downward pressure on TETRA sales, though he notes their rapid growth. “Worldwide, the number of users is set to triple over the next five years, so it’s by far the fastest-growing technology. DMR Tier III, the trunked variation, is growing slower than we projected, but it’s still growing and regionally there are differences in technology, TETRA is more secure, it’s more expensive, it can accommodate more subscribers. So if you’ve got a national police network or a large utility company, they generally opt for high-end TETRA, whereas some subscribers in Asia and Africa with price sensitivities have been seen to adopt DMR Tier III. There has been some adoption of it in the US as well. I don’t think the growth of DMR is taking away from TETRA.”

Anyone attending critical communications events will be aware that public safety organisations are also looking to use body-worn video and unmanned aerial vehicles. While these can lead to significant benefits (not least a sizeable reduction in legal costs and complaints from the public in the case of body-worn video), they all cost money – at a time when budgets are tight. Are they taking money away from TETRA projects?

“In a word, no,” says Darrand. “We had a meeting with a client recently, a police force inspector. One of the messages was that they need voice. If they sound like they’re in a dangerous situation and in need of immediate support, they want to be speaking to a person at the other end, who can assess the tone of their voice, and not an automated GPS locator. As these things develop and remove the need to give a verbal description of a perpetrator, great – but they don’t want that at the expense of voice. So, we are not seeing a decline based on body-worn video cameras, and we are not expecting one for the foreseeable future.”

TETRA around the world

Now that we’ve discussed the macro-trends, how did the major regions fare in 2016? Let’s start with Europe, which Darrand describes as “the biggest TETRA market in the world with approximately 45 per cent of global shipments in 2016”. He expects it to stay “pretty flat”, though a couple of refreshment contracts in Germany “will keep that market buoyant”. He believes the European market will maintain its dominance, despite his predictions that other regions will see faster growth as far as TETRA shipments are concerned.

To what extent is the hype surrounding LTE impacting the European TETRA market? Darrand notes that IHS Markit is seeing lower replacement rates in Europe, “which would suggest that some countries are adopting a wait-and-see policy”. He adds: “Certainly, the likes of Germany are nowhere near it, they’re re-signing contracts for 10 years. There is no doubt that they are TETRA-centric, and the same is true with Belgium and The Netherlands. Other countries are waiting to see what happens. I suspect that France may be one of those, given the stage of evolution it’s at with Tetrapol (the ISI project is integrating Tetrapol and TETRA, which is a positive for Tetrapol).”

Darrand turns his focus to the UK, where – due to the push to replace the Airwave TETRA network with the Emergency Services Network, a public LTE network run by EE (with its own core and supplemental sites to be owned by the Home Office) – “the TETRA market was subdued, as expected, anticipating the deadline of 2020 and the uncertainties over whether Airwave will continue to be left on air or switched off”.

“I do think it will be late, and we know that at the moment LTE doesn’t stand up to critical communications, it’s not robust enough. So, I suspect Airwave will not be switched off in 2020. Organisations will hold off where possible, but we’ve reached a trough. I don’t think terminal shipments will decline any more in the UK, and we may still get some renewals because organisations have held off for a number of years now.”

Turning to the Middle East and Africa (MEA), Darrand says the region’s TETRA market has “declined from last’s year’s peak”, noting that this is due to the fulfilment of a large contract awarded to Sepura by Saudi Arabia, which substantially boosted 2015’s results. He adds that despite the figures for 2016, the MEA market cannot be seen as one in decline and IHS Markit predicts that it will grow at an annual rate of 3-3.5 per cent over the next five years.

Given the recent news from Bravo, Saudi Arabia’s mission-critical network operator, I asked what IHS Markit is projecting for it in terms of TETRA sales. “Looking at the numbers, Saudi Arabia is still seen as a good opportunity for TETRA,” says Lynch. “There is a fair commitment from the Saudi government to push ahead with TETRA, and all the information we are getting from the supply base is that they expect Saudi to still be a good TETRA market. There is some LTE being used in Saudi Arabia, and it will be considered for some of the new regional cities that are being built, but in terms of pure-play public safety and the need to secure for the Hajj, etc., TETRA is still seen as a good technology.”

Over in Asia, Darrand says vendors are still supplying the region with TETRA equipment, adding that China is the single biggest market – responsible for about 40 per cent of TETRA shipments for the region. “Previously we anticipated that the arrangement for the Chinese police forces to use PDT might thwart or reduce TETRA shipments in Asia, but growth in the transportation and commercial sectors has more than compensated for the decline in the public sector. TETRA in Asia is again strong and growing over the next five years.”

Turning to South Korea, which like the UK is planning to have a nationwide LTE network for public safety use, Darrand notes that “it also has a nationwide TETRA network, which is refreshing as well. Sepura won a large contract to service the users [and] replace the nationwide police network. That tells me that they want to keep it until they know how the LTE situation is going to work.”

He adds: “But it is a highly technologically advanced country, and I think that when LTE does stand up on the critical communications side of things, South Korea will move towards LTE and away from TETRA. That assumes that LTE is going to fulfil public safety users’ requirements before 2021. But if I were to assess which country would move to LTE first, South Korea would be my number-one choice, maybe even over the UK in terms of not running [LTE alongside a narrowband network].

“From 2021, depending on the development of LTE, we could start to see TETRA refreshes reduce in South Korea because the first network was installed around 2002. With a 10-year lifecycle, that would have been up for renewal

in 2012-2015. In five years’ time, some users are going to be ready to refresh, and they may well go to LTE if it’s up and running.”

Darrand adds that the Americas region is offering new and unique customers to the TETRA market. “Given that North America is the newest market to adopt TETRA, any deployments are fresh ground for TETRA technology, and the potential for further growth is exciting, while there is also real appetite for TETRA in Latin America, and we are seeing some significant contracts being put forward that require TETRA solutions.

“Outside of China, North America is the largest LMR market – so it is a very good opportunity for TETRA, because while P25 is the de facto public safety technology, the commercial market is growing a lot faster than the public safety market.”

Returning to the big picture, how is 2017 shaping up? “Our estimates indicate a positive trend going forward in TETRA device shipments, albeit a growing replacement market rather than new,” says Darrand. “That said, on a market-by-market basis, TETRA continues to develop, and until 2020 we are seeing no real reason as to why this would not continue, except maybe for a few pockets of markets considering LTE, such as the UK.”

It’s only appropriate that Phil Kidner, CEO of the TCCA, has the last word: “The numbers are the proof – TETRA growth continues in every region and in every sector globally. While LTE is moving forward with the standardisation of features to support mission-critical users, its market implementation is a future event. It is good news for the TETRA industry that the standard remains undeniably robust, trusted and able to deliver significant market impact, while underpinning the introduction of critical broadband.”